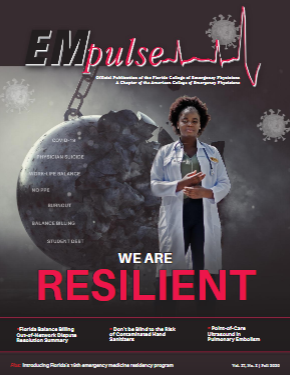

Fall 2020: Medical Economics: Florida Balance Billing OON Dispute Resolution Summary

On July 1, 2016, Florida’s HMO balance billing ban for emergency services was extended to PPO’s and EPO’s (Fla Co. 627.64194 (5)). As a result of advocacy efforts, the regulation requires that insurers must reimburse OON emergency providers at the lesser of: (1) the physician’s charges; (2) the usual and customary charge for similar services in the community where the services were provided; or (3) the mutually agreed upon charge between the physician and the insurance company (Fla Co. 641.513 (5)). This language was designed to protect emergency medicine providers from payors making the unilateral decision to pay according to the payor’s usual and customary rates or other reimbursement methodology.

The Agency for Health Care Administration (AHCA) is contracted with MAXIMUS Federal Services, an independent dispute resolution organization, to provide assistance to health care providers and health plans in order to resolve claim disputes. Maximus is considered the second level appeal process, with the first level appeal being directly with the payor. Maximus has been accepting claim disputes for Florida’s managed care line of business since May 1, 2001. Historically this was not a successful dispute resolution process; however, with the amended regulation it was noted that this was a “new and improved” Maximus.

Problem

When the expanded Florida Balance Billing law went into effect, most ED groups across the state immediately experienced a significant decrease in OON reimbursement, equal to 100% of Medicare, from at least one major payor. Because the reimbursement was not in compliance with the regulation, the appeals process began.

Appealing directly with the payor was the first step and is always important as you want to show that you have done your due diligence to resolve the issue with the payor directly and allow the payor the opportunity to respond. Appeals were submitted, and the payor upheld their original decision, indicating in the written appeals response that reimbursement was in accordance with the payor’s maximum allowable rate.

Aside from the payor’s reimbursement being non-compliant with the regulation, data was available to show that prior to the expansion of the law taking effect, the payor was reimbursing at an amount at least twice of the reduced reimbursement. Appeal responses and data were compiled and presented to the Office of Insurance Regulation on at least two occasions, in an attempt to resolve the matter before moving forward with Maximus, to no avail.

This was now our opportunity as an emergency medicine community to test the “new and improved” dispute resolution process facilitated by Maximus. This historically has not been a very user-friendly process, being labor and time intensive on the ED provider group and revenue cycle management companies. Additionally, the Maximus process can be costly, which deters many provider groups from initiating the process.

Gottlieb, LLC, a Florida-based emergency medicine revenue cycle management company and one of FCEP’s corporate sponsors, filed an initial submission on behalf of an independent ED group. Gottlieb used the initial submission as a test case of the Maximus process, submitting only the minimum required variance amount of $5,000.

Gottlieb’s initial submission and the subsequent two submissions were successful, and Maximus ruled in favor of the ED group. As the non-prevailing party, the payor was ordered by AHCA to pay the ED group for the variance amount claimed, as well as the Maximus costs. These three submissions accounted for roughly an additional $55,000 in return for the ED group. While the results were favorable to the ED group, and the results showed that the Maximus process had improved, there were challenges with enforcement of the final order as illustrated below.

Challenge

AHCA claims that while they issue the order, they have no ability to ensure compliance with the order. There have been instances where the plan paid out on the final order and then subsequently filed overpayment recovery notices and recouped the funds. Most recently, we received a response from the payor regarding two additional submissions. Payor has indicated that Maximus should immediately dismiss the request because the payor does not wish to participate in the process. The law indicates that the process is voluntary for both parties; however, we believe this was intended to mean that either the payor or the group can voluntarily submit a request for Maximus review, and was not intended to mean that the payor can simply decline to participate and get the case dismissed.

Gottlieb, LLC is currently working with an FMA attorney to address the process gaps that currently allow for this dismissal to take place. ■

This article is part of the following sections:

Samantha manages fcep.org and publishes all content. Some articles may not be written by her. If you have questions about authorship or find an error, please email her directly.